|

PREAMBLE

To be clear we are advocating for a future with a diversified energy portfolio that includes

oil and renewables:

This is a Collaboration to "Building Bridges, Not Walls. We believe the future of energy lies in collaboration, not competition. The Elizabeth Swann demonstrates the potential of renewables like solar and hydrogen, while acknowledging the continued importance of oil for a smooth transition."

We're not here to replace oil, but to offer a complementary

solution as partners to progress. The Elizabeth Swann is a testament to how oil companies

might extend their reserves and invest in a sustainable future at the same

time.

The focus is on Transition and Diversification. We are looking to make

the journey smoother. The Elizabeth Swann showcases how renewables can ease the transition to a more sustainable energy mix, ensuring long-term energy security for

everyone.

Working together we envision a future where oil continues to play a role,

alongside a growing portfolio of renewable energy sources like solar and

hydrogen, for a secure future.

The emphasis is on Responsible Resource Management., so extending our subterranean

legacy.

By showcasing the efficiency of renewables, the Elizabeth Swann empowers oil companies to manage their reserves more

conservatively, ensuring a longer lifespan for this valuable resource.

Carrying with it economic and environmental benefits of a diversified energy portfolio.

The

key is Sustainable Stewardship, and conscientious

resource management. The Elizabeth Swann demonstrates that energy companies can be leaders in developing a more sustainable

mix for the future.

Our

project aligns with the stated goals of many oil companies who are actively investing in renewable energy sources.

FINANCIAL

PROJECTIONS

The following is a conservative projection for the market potential of hydrogen-powered ships in the shipping

industry, considering the myriad events promoting the International

Maritime Organization's (IMO)

targets to remove particulates and sulfuric exhaust fumes. While this is an estimate, it provides a glimpse into the exciting possibilities:

2025: From 2025, we anticipate that hydrogen-powered

(including ammonia and methanol) vessels will begin to gain traction. The adoption rate will likely be moderate, with some early adopters in

tugs, coastal ferries, river

cruisers and short-haul routes. Estimated as 2% of the existing ships transitioning to hydrogen fuels.

(111 new hydrogen-powered ships)

Projected Market Value: Approximately $5 billion

worldwide (considering initial investments, retrofitting existing vessels, and new

builds).

2030:

As green hydrogen production scales up due to increased use of offshore wind turbines and solar farms, hydrogen-powered ships will become more commonplace.

Estimated as 5% of the existing ships transitioning to hydrogen fuels. (279 new hydrogen-powered ships)

Projected Market Value: Around $20 billion (factoring in expanded adoption, regulatory incentives, and growing investor interest).

2050:

By 2050, the shipping industry aims to achieve 50% of the commercial

fleets as zero

emissions. Hydrogen-powered vessels will play a pivotal role in this transition.

Estimated as 20% of the existing ships transitioning to hydrogen fuels.

(1,116 new hydrogen-powered ships)

Projected Market Value: A substantial $100 billion (accounting for widespread adoption, replacement of conventional ships, and global demand).

2100:

By 2100, the IMO dictates that commercial shipping should achieve 100%

of the commercial fleets as zero

emissions. Potentially meaning that all new ships will be powered by

ammonia, hydrogen or methanol. Though, other fuels, including battery

electric's are sure to contribute to clean maritime operations.

Keep in mind that these projections are conservative estimates. The actual market value could be

higher if technological advancements, supportive policies, and investor confidence accelerate the shift toward hydrogen-based maritime transport.

· Financial projections and market analysis.

There is as yet no hydrogen (only)

navigation

record to beat. The opportunity to be the first only comes once. We are hoping to

be able to make Jules Verne's

dream come true, with our World Hydrogen Challenge Bunkering

Route (published in draft form in July 2021).

DIESEL

RECORD TO BEAT - The Cable and Wireless adventurer was a stunning achievement in 1998, around the

world in 75 days.

But still the fastest round the world boats are sailing multi-hulls. The

Jules Verne (sailing) Trophee is a record held by Francis

Joyon in the IDEC Sport in 41 days, set in 2017. These are tough

records to beat. They do not happen overnight. They are the result

of years of fine tuning and waiting for ideal conditions. Not to mention

having a team with persistence and backing. Unfortunately, though the

clipper ships of old (Like the Cutty Sark) managed incredible times to

deliver tea, spices and silks, sail power cannot provide reliable container

ship deliveries. Where conventional bunker fuels are being outlawed, one

solution is clean, green and renewable hydrogen.

CONTAINER

SHIPS AND THEIR FUEL CONSUMPTION

1. Container Ship Fleet:

The global container fleet has grown significantly over the years. As of 2022, there are approximately 5,589 container ships in the global fleet

[1]. These vessels are responsible for transporting goods across the world, with a total capacity of over five million TEUs (twenty-foot equivalent units)

[2] [3].

2. Fuel Consumption:

Traditionally, container ships relied heavily on heavy fuel oil (HFO) for propulsion. However, there has been a shift towards cleaner fuels due to environmental concerns.

In 2020, around 65.5 million metric tons of light fuel oil were consumed by ships, compared to just 6.5 million metric tons the year before. This transition was prompted by the

International Maritime Organization (IMO) capping the sulfur content of marine fuels, leading the industry to adopt cleaner alternatives

[4].

The current global shipping fleet consumes roughly 4 million barrels per day of high sulfur fuel oil (such as HFO). However, approximately 3 million barrels per day of that demand is expected to “disappear overnight” as

ship owners switch to lower sulfur fuels [5].

Heavy fuel oil bunkers still account for a significant share of the market, but the trend is shifting towards more sustainable options.

3. Market Dynamics:

The demand for bunker fuel has increased over the years, driven by the growing shipping industry. Around 50% of the total fleet of marine vessels currently uses heavy fuel oil bunkers

[6].

As regulations tighten and environmental consciousness rises, the industry will continue to explore alternative fuels, including

liquefied natural gas (LNG), biofuels, and hydrogen.

The container ship fleet is substantial, and the transition from heavy fuel oil to cleaner alternatives is well underway. As the world focuses on sustainability, the shipping industry plays a crucial role in adopting

greener practices.

HEAVY

FUEL OIL (HFO) FOR MARINE ENGINES POSES SEVERAL ENVIRONMENTAL CHALLENGES

1. Air Pollution:

HFO contains high levels of sulfur, which leads to the emission of sulfur dioxide (SO₂) when burned. SO₂ contributes to acid rain, harming ecosystems and human health.

It also releases particulate matter (PM), which can cause respiratory issues and worsen air quality in port cities.

2. Greenhouse Gas Emissions:

HFO combustion produces significant amounts of carbon dioxide (CO₂), a major greenhouse gas responsible for

global

warming.

The shipping industry’s reliance on HFO contributes to climate change and

sea-level

rise.

3. Black Carbon:

HFO combustion releases black carbon, a fine particulate matter that absorbs sunlight and contributes to the melting of glaciers and ice sheets.

Black carbon deposition on snow and ice reduces their reflectivity, accelerating warming in polar regions.

4. Oil Spills:

Accidental spills during drilling operations, HFO transportation or bunkering can have severe consequences for marine ecosystems.

HFO is viscous and difficult to disperse, leading to persistent oil slicks that harm marine life and coastal habitats.

5. Water Pollution:

HFO contains heavy metals such as vanadium and nickel, which leach into seawater during

combustion.

These metals accumulate in marine organisms, affecting their health and disrupting ecosystems.

6. Bioaccumulation:

Persistent organic pollutants (POPs) found in HFO can accumulate in the food

chain (bio-accumulation).

Fish and other marine organisms ingest these pollutants, posing risks to human health when consumed.

7. Ocean Acidification:

HFO emissions contribute to acidification of seawater due to increased CO₂ levels.

Acidic oceans harm marine organisms, including coral reefs and shell-forming species.

8. Regulatory Pressure:

International regulations, such as the IMO’s sulfur cap, limit the sulfur content in marine fuels.

Ship owners face pressure to transition to cleaner fuels, impacting the demand for

HFO.

In summary, transitioning away from heavy fuel oil towards cleaner alternatives is crucial for safeguarding our environment and achieving sustainable maritime practices.

Investors might consider that it is not just hydrogen ships and

ferries that become attractive for speculators, but also the producers of green renewables and port infrastructure, as

cargo transport transitions from 4 million barrels of oil per day.

By

demonstrating hydrogen technology in action - on the water

and in ports - the Elizabeth Swann (as the SolarSport

HydroRacer™) may assist fleet owners decide which mix

of fuels to use in their new ships. Port operators may also benefit in

deciding what fuels to bunker in place of HFO. Since, actions speak

louder than words.

WHAT IS THE VALUE OF 4M BARRELS OF OIL IN $US DOLLARS

(USD) BASED ON CURRENT MARKET PRICE?

Current Oil Price: As of the most recent data, the Brent crude oil price stands at $82.05 per barrel [11].

Using this price for our calculation.

Conversion to

USD: To convert the price from British Pounds (GBP) to USD, we’ll use the current exchange rate:

1 USD = 0.78 GBP [12].

Therefore, 1 barrel of oil in USD is approximately $82.05 × 0.78 ≈ $64.05.

Total Value:

The value of 4 million barrels would be: 4,000,000 × $64.05 ≈ $256,200,000 (approximately 256.2 million

USD).

So, 4 million barrels of oil at the current market price would be worth approximately

$256.2 million USD per day.

The

annual revenue for oil producers and exporters will be: 365 x

256,200,000 ≈ $93,513,000,000. $93.5

billion USD per year.

TRANSITIONAL

COMPENSATION VIA PERCENTAGE OF PROFITS TO DIVERSIFICATION

As

per the above figures, oil

revenues are likely to fall significantly, by over a third

($30billion USD) to 2050. But the gradual implementation will allow petroleum

producers to invest a percentage of profits year on year in solar

and wind powered electrolyzers, alternative bunkering at ports, and even

promotions to demonstrate to fleet operators. So conserving oil in the

ground, as a long-term asset, and still maintain income levels.

Thus

exporters of crude, may become producers of

clean energy solutions themselves. By 2100, the IMO

requires all commercial shipping to be zero emission. Thus in the fifty

years from 2050 to 2100, oil revenues could drop another $60 billion USD,

to just $3.5 billion USD. Hardly noticeable in that time frame, as

administrations change hands.

We will though, always need oil for chemicals

and plastics. From the date of this

present 'Projection,' increasing in demand to

provide the energy for transition to renewables. After which investment,

on a sliding scale, oil reducing as the supporting infrastructure for

renewables comes on

line.

PLEASE

NOTE: These workings relate only to oil consumption for diesel

powered cargo/container ships. They do not apply to road transport, or diesel

oils for home and factory heating systems.

ESTIMATES:

NUMBERS OF CRUISE SHIPS GLOBALLY FOCUSING ON POPULAR TOURIST

DESTINATIONS

Obtaining a definitive figure is challenging due to constant change

where new ships are built, and older ones might be retired or

re-purposed.

There are also regional variations as clean air policies are applied. Tracking might not be universally standardized across all regions.

The resources for these estimations are included:

Statista providess a 2018 record indicating that in Europe there are some 359 river cruise ships.

Russia: 121 ships

Rest of the world: 119 ships

POPULARITY

The majority of river cruises operate in Europe, particularly along the:

Rhine

Danube

Seine

Mosel

Volga (Russia)

Other popular regions include the

Nile

(Egypt) and the

Mekong (Southeast Asia).

ESTIMATION APPROACH

Based on 2018 data, we might assume a conservative growth rate of 2-3% annually since 2018. Applying regional weightage,

and assign a higher proportion to Europe due to its dominance in river cruising.

RANGE

Low-end: Based solely on 2018 data with minimal growth: 599 ships (Europe: 359, Russia: 121, Others: 119)

High-end: Accounting for moderate growth (2-3%) since 2018:

Europe: 359 * (1 + 0.03)^6 ≈ 440 (6 years of growth)

Total: 599 * (1 + 0.03)^6 ≈ 730

Therefore, a conservative estimate would be around 600-700 river cruise ships globally, with a focus on popular tourist destinations in

Egypt, Europe, Russia, and other regions.

We might apply the same transitional percentages as used above for cargo

shipping. Creating a market for zero emission river tourism.

2025: From 2025, we anticipate that hydrogen-powered

(including ammonia and methanol) vessels will begin to gain traction. The adoption rate will likely be

moderate. Again, estimated as 2% of the existing ships transitioning to hydrogen fuels.

(13 new hydrogen cruise ships)

Projected Market Value: Approximately

$6.5 - 10 billion

worldwide (considering initial investments, retrofitting existing vessels, and new

builds).

2030:

As green hydrogen production scales up due to increased use of offshore wind turbines and solar farms, hydrogen-powered ships will become more commonplace.

Estimated as 5% of the existing ships transitioning to hydrogen fuels. (32 new

hydrogen cruise ships)

Projected Market Value: Around $16-32 billion (factoring in expanded adoption, regulatory incentives, and growing investor interest).

2050:

By 2050, the shipping industry aims to achieve zero

emissions. Hydrogen-powered vessels will play a pivotal role in this transition.

Estimated as 20% of the existing ships transitioning to hydrogen fuels.

(130 new hydrogen cruise ships) Though, in

the case of tourism, with the environment being visibly higher on traveler's

agendas. It is likely that at least half of the river cruising fleet

will be zero emission ≈ 325

vessels. Worth a whopping $300 - 600 billion USD.

BUILD

COST ESTIMATES OF SMALL CRUISE SHIPS

The exact cost of building a small cruise ship depends on several factors, but here's a breakdown to give you an idea:

Size: This is the most significant factor. Small cruise ships typically range from carrying a few hundred to around 2,000 passengers. Costs increase significantly with larger passenger capacity.

Features: The onboard amenities and technology significantly impact the price. Ships with elaborate water parks, multiple restaurants, theaters, and advanced propulsion systems will cost more than those with simpler offerings.

Shipyard: Labor and construction costs can vary depending on the shipyard location. Yards in some Asian countries might be cheaper than those in Europe or North America.

Here's a range for small cruise ship building costs:

- Low-End Estimate: For a very basic small cruise ship with a capacity of around 500 passengers and minimal amenities, the cost could be as low as $550 million.

- High-End Estimate: For a luxurious small cruise ship with a capacity of around 2,000 passengers, featuring top-of-the-line amenities and technology, the cost could reach $1 billion or even more.

Important Note: These are estimates based on industry data. The actual cost of building a small cruise ship can vary depending on the specific factors mentioned above.

Sources:

https://www.cruisehive.com/how-much-does-it-cost-to-build-a-cruise-ship/70619

https://themusterstation.com/

The growing focus on sustainability presents an opportunity for hydrogen-powered river cruise ships. Highlighting the potential to replace existing vessels with cleaner technology, can be attractive to investors.

The JVH2 formula may be applied to newly built river cruisers, by

up-scaling the technology. The 'Elizabeth Swann' based 'SolarSport

HydroRacer™' offers investors an affordable means to promote the

technology with the media, while also demonstrating the technology at

events. One such high profile opportunity, being a Cleopatra

themed "Queen

of the Nile" for operation on the river

Nile.

FURTHER RESEARCH

The River Cruise Line Association (RCLA) in Europe (https://europe.cruising.org/)

American Cruise Line Association (ACLA) in the US (https://cruising.org/)

THE

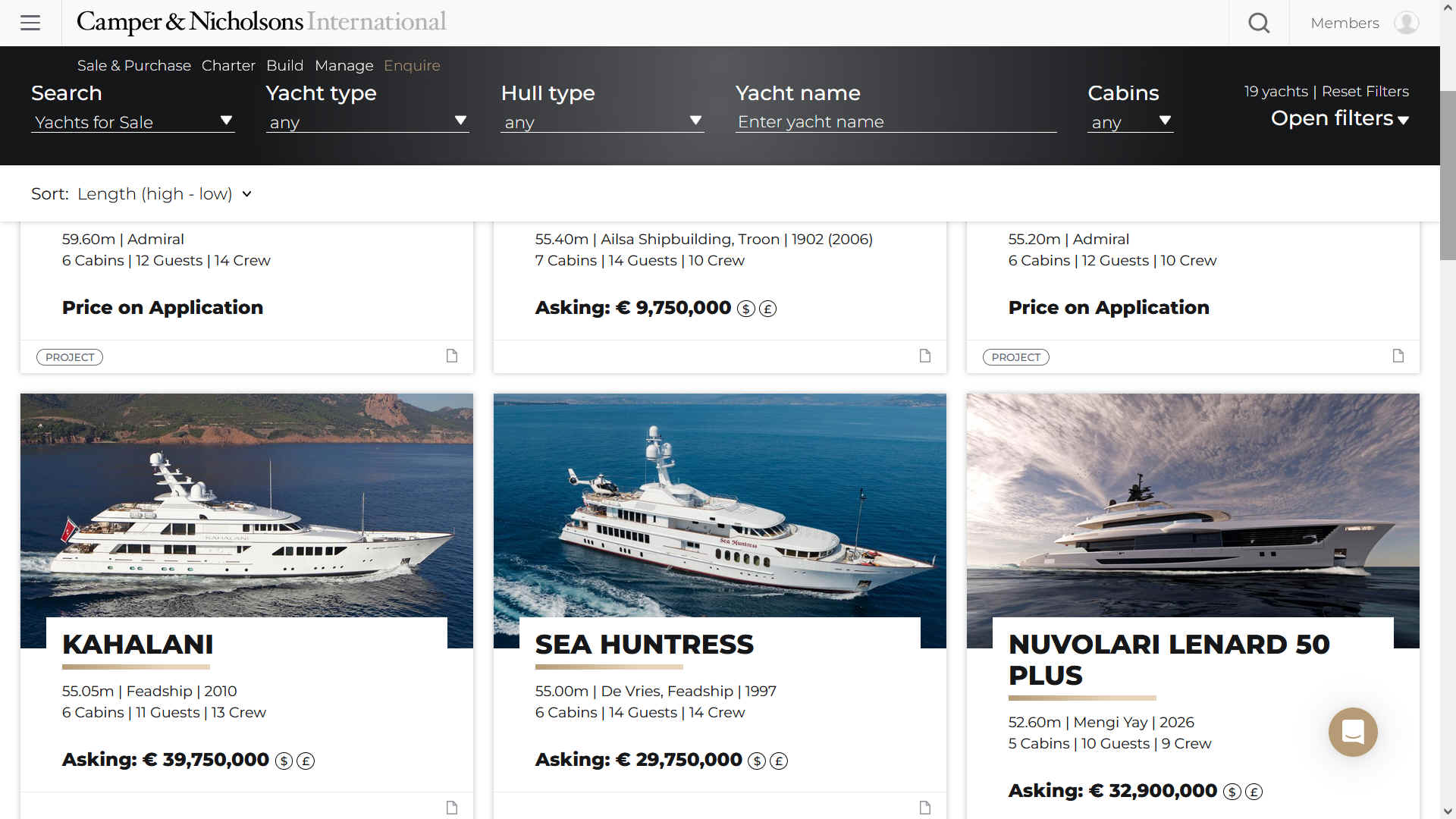

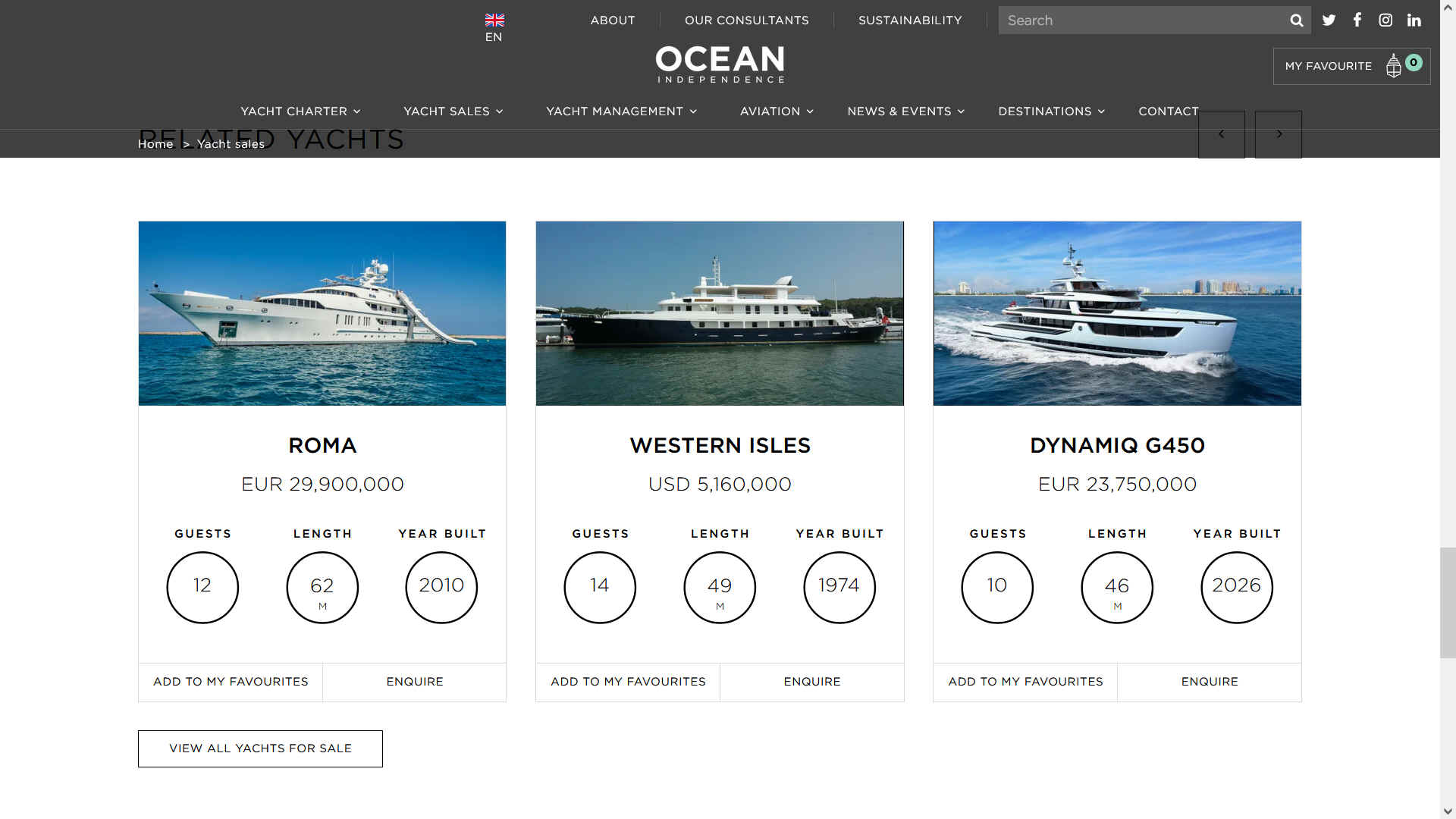

LUXURY POWERED YACHT MARKET

At

time of writing, the most expensive yacht in the world is the 'History

Supreme' at $4.8 billion.

She is built from 10,000 kilograms of solid gold and

platinum and is 100-foot

long, designed by Stuart Huges, for Malaysia’s richest man, Robert

Knok.

After

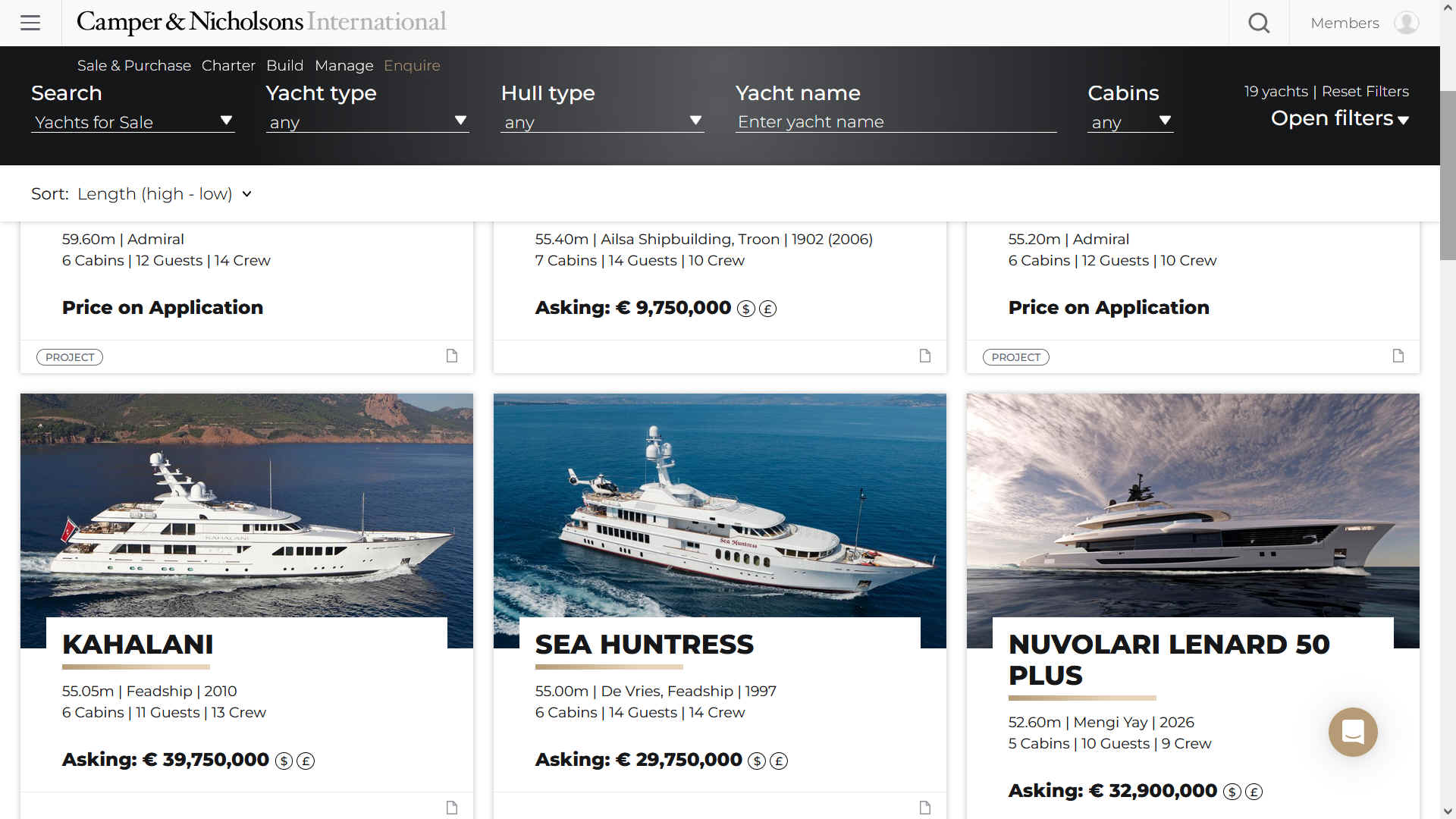

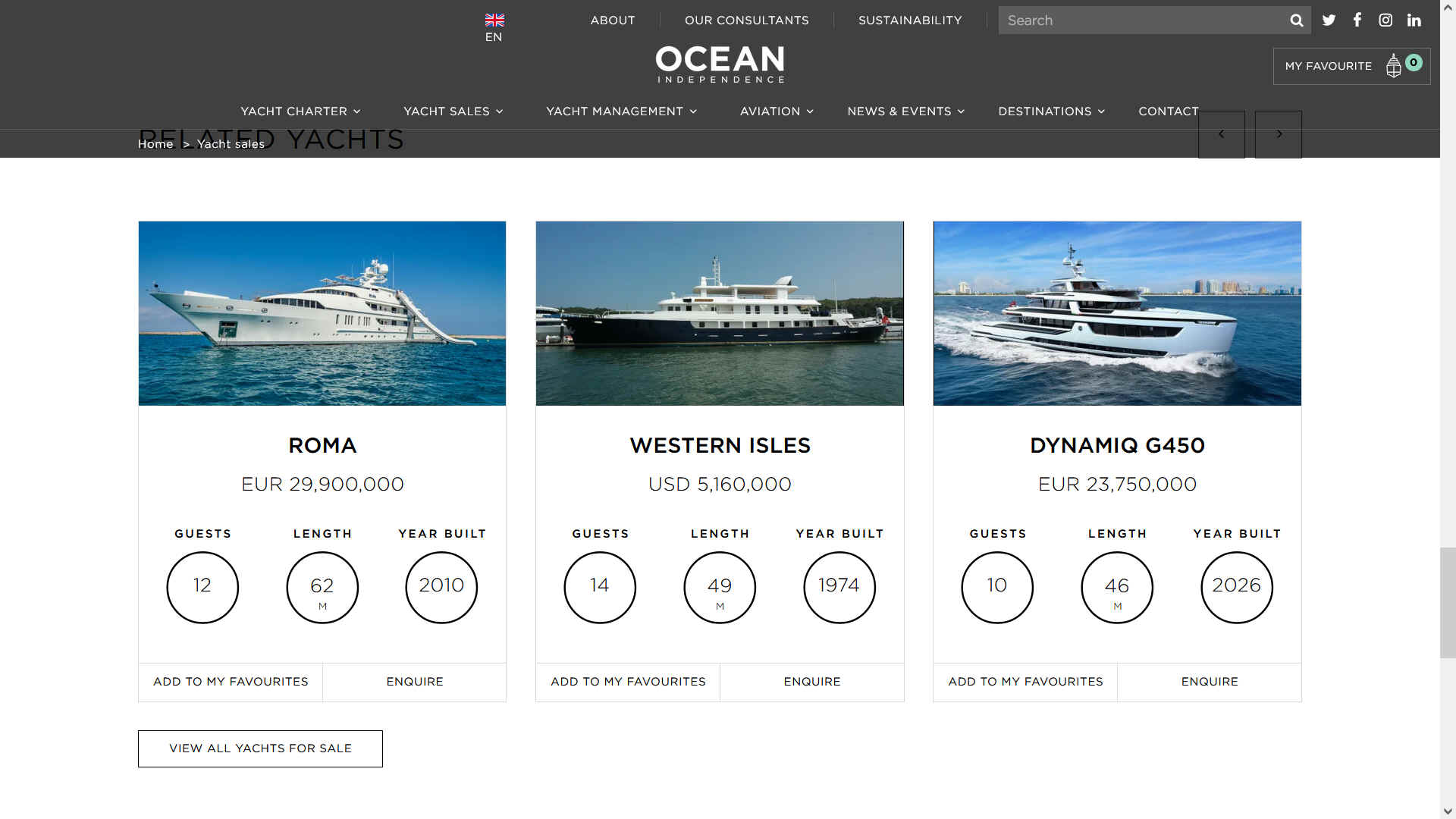

a brief peek at the market, most luxury yachts in the 45 - 55 meter

range sell for between $10 and $40 million USD, new or second user.

Though

the bare bones hull of the Elizabeth Swann is below average market

values. Once relief's and interior furnishings are added, such as for

themed European or Nile cruising, or for custom private motor-boat

sales, we anticipate being competitive around $10-20m USD.

Being

part solar powered, and part hydrogen, cost effective clean cruising using renewable 21st century bunker

fuels, is part of the package. It is practical to cruise using solar

power alone, meaning no fuel to buy. Provided, speeds are contained,

such as in river cruises.

Important Note: These are approximations. Actual numbers on the

day might differ due to constant changes in the industry.

[1]

https://www.statista.com/statistics/198227/forecast-for-global-number-of-containerships-from-2011/

[2] https://www.statista.com/topics/1367/container-shipping/

[3] https://www.statista.com/chart/9901/container-shipping-companies-worldwide-by-number-of-ships/

[4] https://www.statista.com/statistics/1266963/amount-of-fuel-consumed-by-ships-worldwide-by-fuel-type/

[5] https://bing.com/search?q=consumption+of+bunker+heavy+diesel+fuel+oil+in+shipping+industry

[8] https://www.crownoil.co.uk/guides/bunker-fuel-guide/

[9] https://link.springer.com/article/10.1007/s44176-022-00003-2

[6] https://www.fortunebusinessinsights.com/thoughtleadership/bunker-fuel-9375

[7] https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/967763/shipping-fleet-statistics-2020.pdf

[10] https://en.wikipedia.org/wiki/Container_ship

[11]

https://markets.businessinsider.com/commodities/oil-price

[12] https://commodity.com/energy/oil/price/

[13] https://www.oilmonster.com/crude-oil-prices

[14] https://www.theguardian.com/business/live/2022/mar/02/oil-price-blasts-111-opec-meeting-sberbank-european-arm-closed-business-live

[15] https://www.exchangerates.org.uk/commodities/live-oil-prices/OIL-GBP.html

[16] https://www.xe.com/currencyconverter/convert/?From=USD&To=GBP

[17] https://themoneyconverter.com/USD/GBP

[18] https://www.macrotrends.net/1369/crude-oil-price-history-chart

[19] https://www.oilcrudeprice.com/

https://europe.cruising.org/

https://www.statista.com/statistics/1119639/size-of-the-river-cruise-ship-market-worldwide/

https://cruising.org/

https://camperandnicholsons.com/

https://camperandnicholsons.com/

https://www.businessinsider.com/these-are-10-of-the-most-expensive-yachts-in-the-world-2023-1

https://www.oceanindependence.com/

https://www.businessinsider.com/these-are-10-of-the-most-expensive-yachts-in-the-world-2023-1

https://www.oceanindependence.com/

https://europe.cruising.org/

https://www.statista.com/statistics/1119639/size-of-the-river-cruise-ship-market-worldwide/

https://cruising.org/

[1] https://www.statista.com/statistics/198227/forecast-for-global-number-of-containerships-from-2011/

[2] https://www.statista.com/topics/1367/container-shipping/

[3] https://www.statista.com/chart/9901/container-shipping-companies-worldwide-by-number-of-ships/

[4] https://www.statista.com/statistics/1266963/amount-of-fuel-consumed-by-ships-worldwide-by-fuel-type/

[5] https://bing.com/search?q=consumption+of+bunker+heavy+diesel+fuel+oil+in+shipping+industry

[8] https://www.crownoil.co.uk/guides/bunker-fuel-guide/

[9] https://link.springer.com/article/10.1007/s44176-022-00003-2

[6] https://www.fortunebusinessinsights.com/thoughtleadership/bunker-fuel-9375

[7] https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/967763/shipping-fleet-statistics-2020.pdf

[10] https://en.wikipedia.org/wiki/Container_ship

[11]

https://markets.businessinsider.com/commodities/oil-price

[12] https://commodity.com/energy/oil/price/

[13] https://www.oilmonster.com/crude-oil-prices

[14] https://www.theguardian.com/business/live/2022/mar/02/oil-price-blasts-111-opec-meeting-sberbank-european-arm-closed-business-live

[15] https://www.exchangerates.org.uk/commodities/live-oil-prices/OIL-GBP.html

[16] https://www.xe.com/currencyconverter/convert/?From=USD&To=GBP

[17] https://themoneyconverter.com/USD/GBP

[18] https://www.macrotrends.net/1369/crude-oil-price-history-chart

[19] https://www.oilcrudeprice.com/

SOLAR

RECORD TO BEAT - On the 27th of September 2010 Tűranor

PlanetSolar started on a journey around the world from Monaco. With this

expedition, the initiators of the project aimed to focus the public

awareness on the importance of renewable energies for environmental

protection.

After 584 days, Tűranor PlanetSolar returned to Monaco on 4 May

2012 having sailing around the globe.

According to the famous record book: "The longest journey by

boat on solar power only is 32,410 nautical miles (60,023 km; 37,296

miles), by MS TŰRANOR PlanetSolar (Switzerland), which circumnavigated

the world in a westward direction leaving Monaco on 27 September 2010,

passing through the Panama Canal and returning to Monaco after 1 year 7

months and 7 days of navigation, on 4 May

2012, to be included in the Guinness Book of World Records.

Having set

the 1st hydrogen navigation record, the Elizabeth Swann team aim

to beat

the long-standing solar world record, by not fueling with

hydrogen, and

only running on power from the sun, using the advanced tracking

system

to capture incoming solar radiation, to power their ultra-fast

trimaran

hull.

The

JVH2 HydroRacer™ is more than a high-performance vessel; it's a beacon

of innovation with the potential to revolutionize the maritime industry,

in the potential to scale up the technology for cargo carriers and

cruise liners. By embracing this technology, we can collectively

navigate towards a cleaner, more sustainable future for the world's

oceans.

The JVH2 SolarSport™ stands at the forefront of a revolutionary

shift in maritime transportation. This project not only showcases the

viability of hydrogen technology but also presents a unique opportunity

for governments, fleet operators, and oil-producing nations to embrace a

sustainable future without the need for drastic measures, aligning with

the International Maritime

Organization's (IMOs) emission reduction

goals.

|